Federal Solar Tax Credit 2018 Form

Form 1040 this is the standard federal income tax form but thanks to your solar energy system you get to fill in a few extra boxes this year to reduce your tax bill form 5695.

Federal solar tax credit 2018 form. Form 1040 is the standard federal income tax form. The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states. These instructions like the 2018 form 5695 rev. Do not complete part ii.

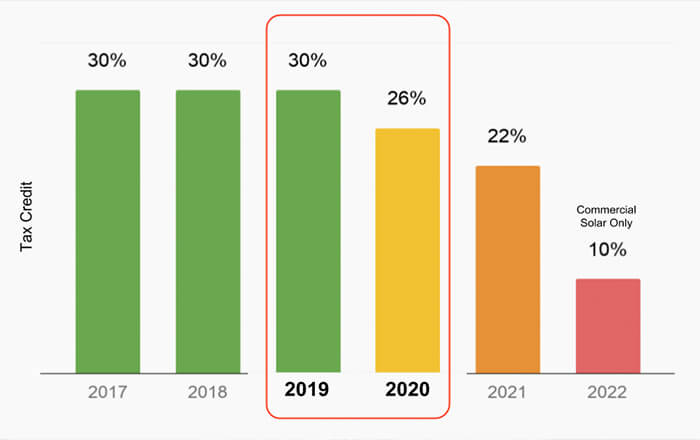

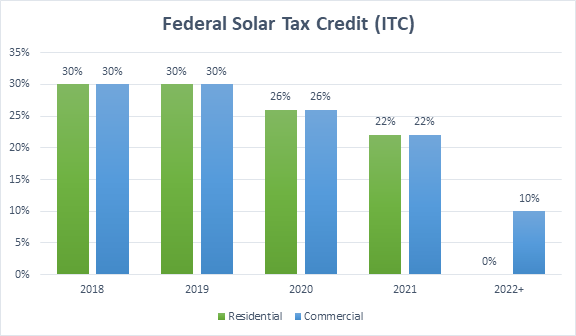

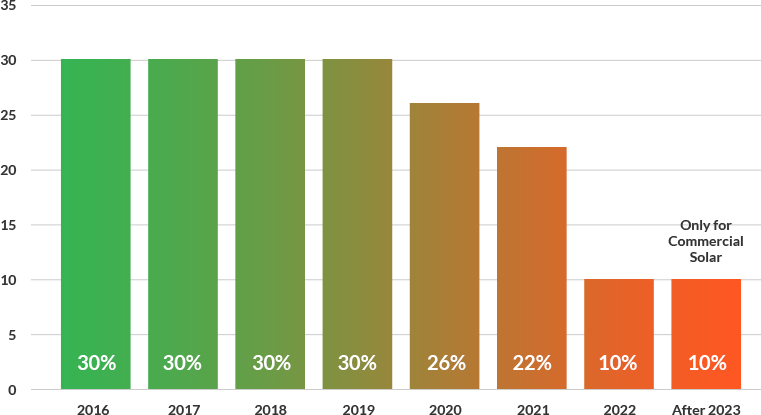

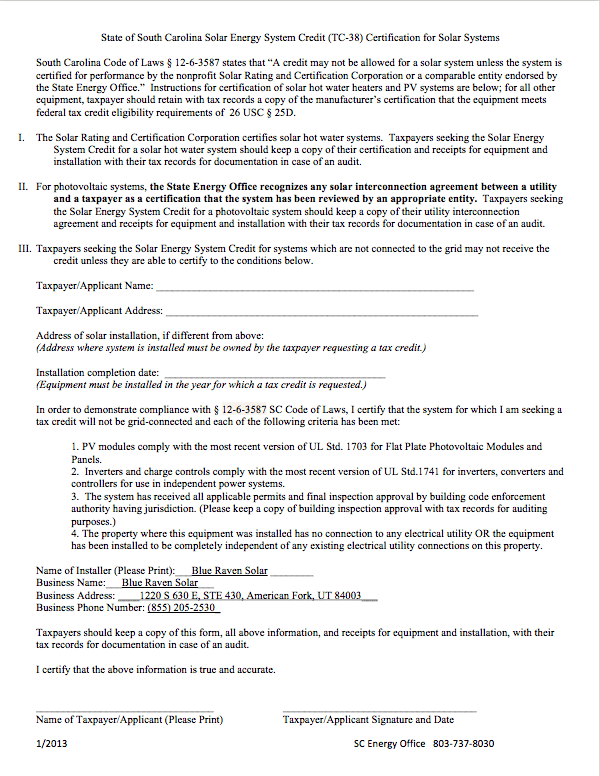

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. If you checked the no box you cannot claim the nonbusiness energy property credit. 5 minutes last updated on august 27 2020. If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 percent of the cost of your solar installation.

To claim the credit you must file irs form 5695 as part of your tax return. February 2020 have been revised to reflect the extension of the nonbusiness energy property credit to 2018 by the taxpayer certainty and disaster tax relief act of 2019. Use these revised instructions with the 2018 form 5695 rev. But this year you get to fill in a few extra boxes to reduce your tax burden.

When you get to line 53 it s time to switch to form 5695. If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs. The information below applies for people whose solar panel installations were fully interconnected and placed into service before midnight on january 1 2020. The federal solar tax credit has now stepped down from 30 to 26 for all installations completed in 2020.

About form 4255 recapture of investment credit about form 8453 u s. The information below is current for people filing 2019 taxes. Federal solar tax credit filing step by step. Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

To file your federal solar itc you will need two irs tax forms along with their instructions. Fill in form 1040 as you normally would. You calculate the credit on the form and then enter the result on your 1040.